Results are coming out for DEC 2010 Exam

Well for the students that attempted the F8 and P7 papers in Dec 2010, the current period will be stressful - results are coming out - Feb 21.

It is time for you to reflect back on what was your strong points during the last sitting and what was the weak points, this should help you learn about your own abilities and use them better for the coming examination.

In terms of pass rates, Malaysian students are inherently weak in written papers and stronger in the calculation papers, hence that is why students love to studying for F5, F6, F7 and F9 and dislike the F4 and F8 papers. The historical pass rates for Malaysia has always been lower than the average pass rate for the world for theory papers.

I suppose that the only way for the students to perform better is to accept this facts and find a way to overcome this inherent perception of theory papers. A simple shift in your mind about the papers can make a significant difference in the manner in which you acquire knowledge.

The other reason for poor performance in students - cramming everything in the last minute. Well it is possible to do this, but then you will never appreciate the subject matter that is being studied and studied only to pass the exam. Appreciation of the subject matter and understanding the variability of contextual application would allow for improved overall performance in professional papers.

Depending too much on question spotting is a bad idea, since it narrows down your scope and may impair you ability to fully appreciate a situation that draws on other areas of knowledge.

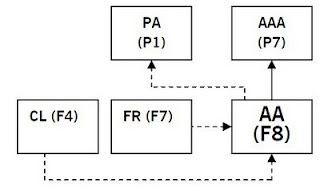

Overall a review of the past papers for P7 and F8 seems to indicate that you need to approach the audit paper with an integrated approach (using knowledge studied in F7, P1 and P2) to support your answers. In my opinion, both the papers were set at a fairly reasonable intellectual level for ACCA students.

If you did not get a pass - decide the reasons for failure

1. Lack of understanding

2. Lack of reading and review of studied material

3. Lazy

4. Distracted

5. Last minute studies = High risk of fundamental error (since you will answer what you have studied last minute rather than what the question was asking for)

Students that are interested in improving your chances for the papers F8 and P7, you can attend the classes for them in Jpro training

Good luck on the results

F8 & P7 for JUNE 2011

In the past, this paper only had F3 moving into the F8 paper, but the new examined Pam Bahl has decided to ensure that accounting standards are examined in the audit paper, this doubles the effect of the accounting standards.

It can be seen that this paper also has some flow over from F4 Law paper, which means that having a sound legal knowledge should improve your understanding of audit.

Well whats the impact in terms of amount of knowledge in the paper - actually there was some reduction in the new syllabus

Reduction in some issues about internal audit reporting and operational audits that cover marketing, HR and treasury

There is also a removal of the IT aspect of the audit issues that was initially increased due to the previous syllabus change but was never ever examined properly- so that is good news.

The increase is the implication of the accounting standards on risk

such as IAS 2 - Risk that inventory may be valued wrongly (higher of cost or NRV), but now you have to go into the exam with all the standards in F7, hopefully with the exception of group based standards (which is only examinable in P7)

I am currently only teaching this paper in KDU, Sunway JB.

The DATE F8 will be held for JPro is provided below:

Those that are staying near to Shah Alam and Klang can consider my centre for easy of access (since there is a new exit that links the Kesas direct to my centre)

The classes for my centre is usually 7 hours per week on Wednesday, classes will start after results are out from (9 - 5 pm)

24 Feb x 7

2 Mar x 7

16 Mar x 7

30 Mar x 7

13 Apr x 7

27 Apr x 7

(9 - 6 pm)

25 May x 8

26 May x 8

27 May x 8

Complete coverage of the paper + revision will be RM1,000 - SMS your name to 0178786074 to confirm your seats.

For the P7 Paper - I will only be teaching in Sunway JB and my centre.

DATE P7 for Jpro is as follows [8hours per day (8.30 - 5.30)]

19 & 20 Feb

12, 13 & 19 March

2, 9, 10 April

Revision - 28,29,30, 31 May

Areas that may be examined in the coming F8 exam

Well it would appear that the following issues may be making an appearance

- ISA 620 (expert)

- ISA 530 (sampling)

- ISA 230 (audit documentation)

- ISA 210 (engagement letter)

- ISA 705 (audit report - modification)

- ISA 560 (subsequent events)

- ISA 450 (material misstatements)

- ISA 402 (Outsourcing)

- ISA 610 (Internal audit)

It would suppose that there will be a question that has the following aspects

- Audit evidence for the balance (NCA / Payable / Receivable / Inventory)

- Audit evidence for transaction (Sales / Wages / Purchases)

- Test of controls over purchases or sales system

- Deficiencies in the sales or purchases system

- Internal audit procedures - VFM audit, need for internal audit, internal audit importance.

Answers for mock question

Your firm was appointed as auditor to Indigo Co, an iron and steel corporation, in September 2005. You are the manager in charge of the audit of the financial statements of Indigo, for the year ending 31 December 2005.

Indigo owns office buildings, a workshop and a substantial stockyard on land that was leased in 1995 for 25 years. Day-to-day operations are managed by the chief accountant, purchasing manager and workshop supervisor who report to the managing director.

All iron, steel and other metals are purchased for cash at ‘scrap’ prices determined by the purchasing manager. Scrap metal is mostly high volume. A weighbridge at the entrance to the stockyard weighs trucks and vans before and after the scrap metals that they carry are unloaded into the stockyard.

Two furnaces in the workshop melt down the salvageable scrap metal into blocks the size of small bricks that are then stored in the workshop. These are sold on both credit and cash terms. The furnaces are now 10 years old and have an estimated useful life of a further 15 years. However, the furnace linings are replaced every four years. An annual provision is made for 25% of the estimated cost of the next relining. A by-product of the operation of the furnaces is the production of ‘clinker’. Most of this is sold, for cash, for road surfacing but some is illegally dumped.

Indigo’s operations are subsidised by the local authority as their existence encourages recycling and means that there is less dumping of metal items. Indigo receives a subsidy calculated at 15% of the market value of metals purchased,

as declared in a quarterly return. The return for the quarter to 31 December 2005 is due to be submitted on 21 January 2006.

Indigo maintains manual inventory records by metal and estimated quality. Indigo counted inventory at 30 November 2005 with the intention of ‘rolling-forward’ the purchasing manager’s valuation as at that date to the year-end quantities per the manual records. However, you were not aware of this until you visited Indigo yesterday to plan your year-end procedures.

During yesterday’s tour of Indigo’s premises you saw that:

(i) sheets of aluminium were strewn across fields adjacent to the stockyard after a storm blew them away;

(ii) much of the vast quantity of iron piled up in the stockyard is rusty;

(iii) piles of copper and brass, that can be distinguished with a simple acid test, have been mixed up.

The count sheets show that metal quantities have increased, on average, by a third since last year; the quantity of aluminium, however, is shown to be three times more. There is no suitably qualified metallurgical expert to value inventory in the region in which Indigo operates.

The chief accountant disappeared on 1 December, taking the cash book and cash from three days’ sales with him. The cash book was last posted to the general ledger as at 31 October 2005. The managing director has made an allegation of fraud against the chief accountant to the police.

The auditor’s report on the financial statements for the year ended 31 December 2004 was unmodified.

Required:

(a) Describe the principal audit procedures to be carried out on the opening balances of the financial statements of Indigo Co for the year ending 31 December 2005. (6 marks)

(b) Using the information provided, state the audit risks arising and justify an appropriate audit approach for Indigo Co for the year ending 31 December 2005. (14 marks)

(c) Comment on the matters to be considered in seeking to determine the extent of Indigo Co’s financial loss resulting from the alleged fraud. (6 marks)

(d) Matters to be considered before experts are used in the audit (4 marks)

(30 marks)

INDIGO CO

(a) Opening balances – principal audit procedures

■ Review of the application of appropriate accounting policies in the financial statements for the year ended 31 December 2004 to ensure consistent with those applied in 2005.

■ Where permitted (e.g. if there is a reciprocal arrangement with the predecessor auditor to share audit working papers on a change of appointment), a review of the prior period audit working papers.

■ Current period audit procedures that provide evidence concerning the existence, measurement and completeness of rights and obligations. For example:

❑ after-date receipts (in January 2005 and later) confirming the recoverable amount of trade receivables at

31 December 2004;

❑ similarly, after-date payments confirming the completeness of trade and other payables (for services);

❑ after-date sales of inventory held at 31 December 2004;

❑ review of January 2005 bank reconciliation (confirming clearance of reconciling items at 31 December 2004).

■ Analytical procedures on ratios calculated month-on-month from 31 December 2004 to date and further investigation of any distortions identified at the beginning of the current reporting period. For example:

❑ inventory turnover (by category of metal);

❑ average collection payment;

❑ average payment period;

❑ gross profit percentage (by metal).

■ Examination of historic accounting records for non-current assets and liabilities (if necessary). For example:

❑ agreeing balances on asset registers to the client’s trial balance as at 31 December 2004;

❑ agreeing statements of balances on loan accounts to the financial statements as at 31 December 2004.

■ If the above procedures do not provide sufficient evidence, additional substantive procedures should be performed. For example, if additional evidence is required concerning inventory at 31 December 2004, cut-off tests may be

reperformed.

(b) Audit risks Assets

■ There is a very high risk that inventory could be materially overstated in the balance sheet (thereby overstating profit) because:

❑ there is a high volume of metals (hence material);

❑ valuable metals are made more portable;

❑ subsidy gives an incentive to overstate purchases (and hence inventory);

❑ inventory may not exist due to lack of physical controls (e.g. aluminium can blow away);

❑ scrap metal in the stockyard may have zero net realisable value (e.g. iron is rusty and slow-moving);

❑ quantities per counts not attended by an auditor have increased by a third.

■ Inventory could be otherwise misstated (over or under) due to:

❑ the weighbridge being inaccurate;

❑ metal qualities being estimated;

❑ different metals being mixed up; and

❑ the lack of an independent expert to identify/measure/value metals.

■ Tangible non-current assets are understated as the parts of the furnaces that require replacement (the linings) are not capitalised (and depreciated) as separate items but treated as repairs/maintenance/renewals and expensed.

■ Cash may be understated due to incomplete recording of sales.

■ Recorded cash will be overstated if it does not exist (e.g. if it has been stolen).

■ Trade receivables may be understated if cash receipts from credit customers have been misappropriated.

Liabilities

■ The provision for the replacement of the furnace linings is overstated by the amount provided in the current and previous year (i.e. in its entirety).

Tutorial note: Last replacement was two years ago.

Income statement

■ Revenue will be understated in respect of unrecorded cash sales of salvaged metals and ‘clinker’.

■ Scrap metal purchases (for cash) are at risk of overstatement:

❑ to inflate the 15% subsidy;

❑ to conceal misappropriated cash.

■ The income subsidy will be overstated if quantities purchased are overstated and/or overvalued (on the quarterly returns) to obtain the amount of the subsidy.

■ Cash receipts/payments that were recorded only in the cash book in November are at risk of being unrecorded (in the absence of cash book postings for November), especially if they are of a ‘one-off’ nature.

■ Expenditure is overstated in respect of the 25% provision for replacing the furnace linings. However, as depreciation will be similarly understated (as the furnace linings have not been capitalised) there is no risk of materialmisstatement to the income statement overall.

Disclosure risk

■ A going concern (‘failure’) risk may arise through the loss of:

❑ sales revenue (e.g. through misappropriation of salvaged metals and/or cash);

❑ the subsidy (e.g. if returns are prepared fraudulently);

❑ cash (e.g. if material amounts stolen).

Any significant doubts about going concern must be suitably disclosed in the notes to the financial statements.

Disclosure risk arises if the requirements of IAS 1 ‘Presentation of Financial Statements’ are not met.

■ Disclosure risk arises if contingent liabilities in connection with the dumping of ‘clinker’ (e.g. for fines and penalties) are not adequately disclosed in accordance with IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’.

Appropriate audit approach

■ A risk-based approach is suitable because:

❑ inherent risk is high at the entity and financial assertion levels;

❑ material errors are likely to arise in inventory where a high degree of subjectivity will be involved (regarding quality of metals, quantities, net realisable value, etc);

❑ it directs the audit effort to inventory, purchases, income (sales and subsidy) and other risk areas (e.g. contingent liabilities).

■ A systems-based/compliance approach is not suited to the risk areas identified because controls are lacking/ineffective (e.g. over inventory and cash). Also, as the audit appointment was not more than three months ago and no interim audit has been conducted (and the balance sheet date is only three weeks away) testing controls is likely to be less efficient than a substantive approach.

■ A detailed substantive/balance sheet approach would be suitable to direct audit effort to the appropriate valuation of assets (and liabilities) existing at balance sheet date. Principal audit work would include:

❑ attendance at a full physical inventory count at 31 December 2005;

❑ verifying cash at bank (through bank confirmation and reconciliation) and in hand (through physical count);

❑ confirming the accuracy of the quarterly returns to the local authority.

■ A cyclical approach/directional testing is unlikely to be suitable as cycles are incomplete. For example the purchases cycle for metals is ‘purchase/cash’ rather than ‘purchase/payable/cash’ and there is no independent third party evidence to compensate for that which would be available if there were trade payables (i.e. suppliers’ statements). Also the cycles are inextricably inter-related to cash and inventory – amounts of which are subject to high inherent risk.

■ Analytical procedures may be of limited use for substantive purposes. Factors restricting the use of substantive analytical procedures include:

❑ fluctuating margins (e.g. as many factors will influence the price at which scrap is purchased and subsequently sold, when salvaged, sometime later);

❑ a lack of reliable/historic information on which to make comparisons.

Extent of alleged fraud – Matters to be considered

■ Details reported to police: The managing director may have made some estimate of the possible extent of the fraud in reporting the chief accountant’s disappearance to the police.

■ The minimum loss (assuming no insurance) would be sales for the three days before he left. If not known (e.g. because the only record of them was in the cash book) a simple estimate might be 3/20 × total recorded revenue for a typical month.

■ The pattern of cash bankings extracted from bank statements: A falling trend starting during the year might mark the time from which the chief accountant began to misappropriate cash.

■ Whether other managers have voiced their suspicions, if any, on the chief accountant’s behaviour. For example, if there was any marked change in his lifestyle (what he appeared to spend his money on, the hours he worked, etc).

■ The prior year auditor’s report was unmodified. If this was appropriate the chief accountant’s alleged fraudulent activities may have only started in the current year.

■ The amount of fidelity insurance cover (i.e. against employees handling cash) that Indigo has taken out to meet any claim for fraud.

■ The likelihood, if any, of recovering misappropriated amounts. For example, if the chief accountant has assets (e.g. a house) that can be used to settle Indigo’s claims against him in the event that he is caught/successfully prosecuted.

d) Matter to be consider for ISA 620

n Whether there is internal experts for the area

n The level of risk associated to the matter – higher risk would require expert involvement

n The materiality of the matter at hand – if matter is material experts should be used

n Level of experience the auditor has with the area

n The availability of the resources within the firm to support the area

Question 2

Engagement letter

(a) Contents of an engagement letter

– Objective of the audit of the financial statements

– Management’s responsibility for the financial statements

– The scope of the audit with reference to appropriate legislation

– The form of any report or other communication of the results of the engagement

– The auditor may not discover all material errors

– Provision of access to the auditor of all relevant books and records

– Arrangements for planning the audit

– Agreement of management to provide a representation letter

– Request that the client confirms in writing the terms of engagement

– Description of any letters or reports to be issued to the client

– Basis of fee calculation and billing arrangements.

(b) Types of audit evidence

– Inspection – examination of records or documents in whatever form eg manual computerised, external or internal.

– Observation – looking at the processes or procedures being carried out by others.

– Inquiry – seeking information from knowledgeable persons, both financial or non-financial, either within or outside the entity being audited.

– Confirmation – the process of obtaining a representation of an existing condition from a third party eg a receivables letter.

– Recalculation – checking the mathematical accuracy of documents or records.

– Reperformance – this is the auditor’s independent execution of procedures or controls that were originally performed as part of the entity’s internal control system.

– Analytical procedures – evaluation of financial information made by a study of plausible relationships among both financial and non-financial data.

(c) Modification of audit reports

Qualification – inability to obtain appropriate sufficient evidence. Used where the audit cannot obtain sufficient evidence regarding an item in the financial statements.

Qualification – material misstatement. Used where the auditor disagrees concerning the amount or disclosure of an item in the financial statements.

Adverse – material & pervasive misstatement. Used where auditor disagrees concerning the amount and disclosure of an item in the financial statement which is significant to the financial statement

Disclaimer of opinion – material and pervasive inability to obtain appropriate sufficient evidence. Used where auditor cannot verify a significant element in the financial statement

Question 3

(a) Materiality

· It is never appropriate to apply the prior year's materiality figure to the current year figures.

· Materiality shou ld be assessed in each year.

· If the financial position has not changed much, and the results are very comparable with the prior year, it is possible that the materiality assessed year-on-year is very similar, but this does not mean that the auditors should not assess it for each audit.

· When assessing materiality, the auditor must consider all known factors at the current date. In this case, the position has changed considerably, increasing the risk of the audit, which may lower materiality itself.

· As the SOFP position has changed considerably, when materiality is assessed, it is unlikely that it will be similar to the prior year.

· Using the information available, materiality is likely to be assessed extremely low in monetary terms, due to the overall decrease in assets and the loss that appears to have been made in the year.

· It is also possible that given the current SOFP position, the SOFP figures will not be used to assess materiality in this year.

(b) Audit risk

Audit risk is the risk that the auditor will give an inappropriate opinion on financial statements. It is made up of three different elements of risk:

• Inherent risk: the risks arising naturally in the business and specific accounts/transactions

• Control risk: the risk that the accounting system will fail to detect and prevent errors

• Detection risk: the risk that the auditors will not detect material misstatements

Detection risk comprises sampling risk (the risk that the auditors' conclusion drawn from a sample is different to what it would have been, had the whole population been tested) and non-sampling risk (the risk that auditors may use inappropriate procedures or misinterpret evidence).

Inherent and control risk are assessed by the auditors. Detection risk is then set at a level which makes overall audit risk acceptable to them.

(c) Specific audit areas of risk

A review of SOFP suggests that audit work should be directed to the following areas:

Going concern

The balance sheet has reduced considerably in value since the previous year. Total assets have fallen from $373,000 to $165,000. Although the income statement has not been reviewed, the SOFP shows a retained loss for the year of $211,000.

Net assets show a reduction in both inventory and receivables, whichsuggests a decrease in activity, although trade payables do not seem to have fallen so considerably.

However, this could be accounted for by Glo-Warm not paying its suppliers in a similar fashion to the previous year. It will be necessary to review the income statement to substantiate whether activity has reduced.

The cash position has also worsened, with cash falling by $22,000.

The cash flow statement should reveal more detail about this fall. However, the company has paid off $5,000 of its bank loan, reducing overall net debt.

In summary, audit work should be directed at going concern as several indicators of going concern problems exist on the balance sheet. This will be further amplified when the income statement is available.

Inventory

Inventory has been mentioned above in the context of going concern.

Audit work should be directed at inventory specifically as this balance has fallen significantly from the previous year, which seems odd in a manufacturing company. There is no suggestion on the balance sheet for why this should be so (for example, receivables are not correspondingly high, suggesting high pre-year end sales, and payables are not correspondingly low, suggesting low pre-year end purchases). It may be that the inventory count did not include every item of inventory. Alternatively it could simply point to a fall in activity (discussed above).

Warranty provision

A provision of $20,000 has been included in 2006 for warranties. The reasons for this must be investigated and the auditors must check that it has been accounted for correctly.

It seems odd that a warranty provision should suddenly appear in a balance sheet. It suggests a change in the terms of contracts given to customers, or a change in the customers themselves (with different terms then applying). Alternatively it suggests that IAS 37 has been wrongly applied in the current year, or should have been applied in the previous year, and was not.

Other material items

As stated above, given the indications of loss and the reduction in total asset value, it is likely that materiality will be assessed low in monetary terms. In this case, most balances on the balance sheet are likely to be material (excluding investments and cash-in-hand which appear to be very low risk).

However, as the bank loan is likely to be substantiated by good audit evidence, the most risky of the other balances are trade receivables and trade payables, for reasons discussed above in going concern. More detail is required to make a judgement about the risk of tangible non-current assets.

Question 4

Deficiencies | Implication | Controls |

No review of the sales ledger is done | There is a risk that some of the customers may have not paid and may be missed out – leading to wasted interest cost | The sales ledger should be reviewed on a monthly basis and customer statements be sent out |

Miss Jones opens the mail and post all the transactions | There is a risk that Miss Jones may pocket some of the receipts – teeming and lading fraud | The mail opening should be done with the 2 accounting staffs |

Sales reps takes orders directly from the client | There is a risk that orders may be accepted from non-creditworthy customers | Orders should only be accepted from clients that have a credit check verified |

Invoices are filled alphabetically | There is a risk that invoices may be omitted leading to possible omission from records | Invoices should be filled in sequential numbers and regular sequence checks should be performed |

Order are accepted before the checking availability of the invoice | This could result in losses if the possible item is not in stock and needs to be ordered urgently | Orders should only be accepted by sales staff after checking the availability of inventory |

Question 5

The following issues are still pending in the audit of Builder Merchants, all other matters related to the audit has been completed.

a) Some of the inventory sheets have been lost before you could confirm them. There is no alternative way for you to confirm $75,000 of the inventory included in $640,000

b) In the receivable value of $580,000, there is a debt amounting $45,000 from a customer that has gone into liquidation. Liquidators have confirmed that there is no distribution possible but the directors have resisted including a provision for this. The profit before tax is $100,000

c) The accounts of Builder Merchant does not include a cash flow statement

d) A substantial claim has been lodged by a customer against Builder Merchant. The matter has been included in the notes No provision has been included since value cannot be estimated reliably. Lawyers have confirmed that the claim can be defended successfully.

(a)

This represents an inability to obtain appropriate sufficient evidence because the'missing' inventory represents 12% of the total. The auditor would expect all inventory counting sheets to be available. The auditor’s report would be modified.

The basis of opinion paragraph would refer to the fact that the inventory counting sheets for this depot were lost. The opinion would state that "except for" adjustments that may have been necessary in relation to these inventory, the financial statements give a true and fair view.

The auditor’s report would also state that in relation to inventory quantities:

- all information and explanations considered necessary were not obtained; and

- the auditor was unable to determine whether proper accounting records were kept.

(b)

This represents a material misstatement. The debt represents 8% of the total receivables balance and 45% of the profit for the year.

The auditor’s report would be modified with qualified opinion.

The opinion paragraph would refer to the fact that the customer is in liquidation and there is little prospect of payment. It would also state that net assets and profits are overstated by $45,000.

The actual opinion would state that "except for" the absence of this allowance the financial statements give a true and fair view.

(c)

As the client is listed, its accounts should include a cash flow statement. The audit opinion should therefore be qualified on the grounds of material misstatement.

This misstatement is not pervasive to the accounts, it is limited to the cash flow statement, so this would be an except for qualification.

The opinion section should be headed 'Basis of Qualified Opinion'. It should state that the accounts give a true and fair view and have been properly prepared in accordance with an applicable financial reporting framework except for the omission of a cash flow statement.

The omission should be detailed in a paragraph above the opinion section, where the auditors should give details of the net cash flows and state that in their opinion, information about the cash flows is necessary for a proper understanding of the company's affairs.

(d) The auditors need to determine whether the legal claim is a material matter and even whether it is pervasive to the accounts as a whole. For example, if the customer involved is a major customer, it could be that an adverse outcome could affect the going concern basis of the company.

It appears that the disclosure in the financial statements is adequate and there appears to be no basis on which to make a provision in the financial statements.

Therefore there is no question that there is a material misstatement in the FS.

However, the audit report will be affected by the fact that there is an uncertainty affecting the business. The auditors will have to decide whether the inherent uncertainty is material or fundamental.

If material, it does not need to be mentioned in the audit report.

However, if they decide that it is fundamental, the report should contain an emphasis of matter paragraph giving the appropriate details.

It should also state that the opinion is not qualified in relation to this matter.

Thereafter, no reference should be made to the legal claim in the opinion section of the report.

No comments:

Post a Comment